CGT Returns…..Do clients need to file one and what’s the penalty if they are late?

Capital Gains Tax » October 21, 2021

HMRC has issued over £1.3m in late filing penalties since the introduction of legislation requiring UK residents to submit Capital Gains Tax (CGT) returns, and pay any CGT due, within 30 days of completion of the sale or transfer of residential property.

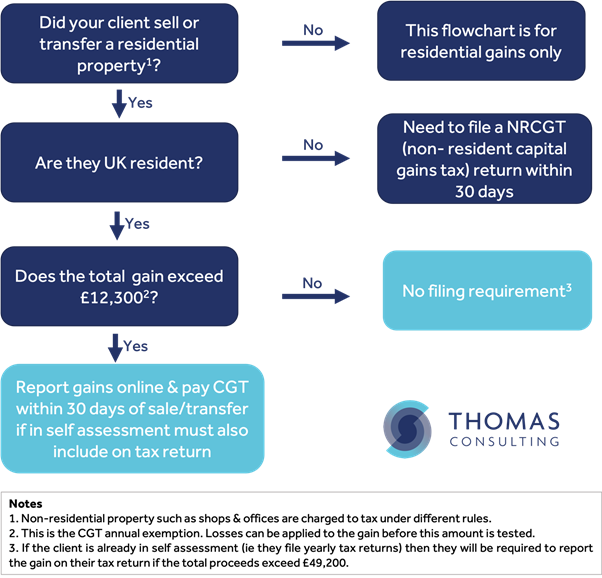

Filing requirements

If a client sells or transfers a property that is exempt from CGT (for example, their home which they have lived in for the whole time they have owned it) then they do not need to file a CGT return online. It is worth checking to see if a client will have a responsibility to report their CGT to HMRC. We have prepared this brief flowchart to help.

Penalties

If your client has a filing requirement, the penalties for late filing are as follows:-

- A penalty of £100 if the return is not filed within 30 days;

- A further penalty of £300 or 5% of any tax due, whichever is greater if the deadline is missed by more than 6 months;

- A further penalty of £300 or 5% of any tax due, whichever is greater if the deadline is missed by more than 12 months.

Support

We can prepare and file CGT returns, as well as self-assessment tax returns.

If a client has their HMRC logins we can be authorised to complete the returns in a matter of minutes. Of course, if they do not have the logins to hand, we can support them in requesting these. This can take a few weeks (as usually the backup codes will be posted to clients), therefore, if it is anticipated that a CGT return will be required, the sooner we are instructed the better.