Former Matrimonial Home

Tax Advice » November 5, 2021

There is a significant tax relief available on the family home, however, it is restricted in two cases:

(1) where the individual has not lived in the home for the whole time of ownership; and

(2) where the gardens and grounds of the home exceed an acre[1].

Principal Private Residence (PPR) relief

When an individual has lived in a property as their main home they are entitled to Principal Private Residence (PPR) relief when the property is sold[2]. The relief is available for the home and grounds up to an acre. The relief is available for periods of occupation only. There are two types of occupation; actual and deemed. Actual occupation is where the individual was living in the property. Deemed occupation is where the legislation allows for a period of absence to be treated as occupation.

Deemed occupation

The final nine months of ownership are always considered deemed occupation[3]. There are primarily three other types of absence which are counted as deemed occupation:-

- when the taxpayer was away from the home due to working overseas (uncapped) [4]

- where the taxpayer was working away from home in the UK (up to four years)[5]

- any absence up to three years [6]

The above reliefs are known as ‘sandwiched’ reliefs as the individual has to be living in the property as their main home before and after the absences. For the first two scenarios, if the individual has been unable to return to the home due to the location of their work, PPR relief would still be available.

s.225b relief

In certain circumstances, it is possible to extend the period of deemed occupation until the point of transfer or sale. This permission is granted at s.225b of the Taxation of Capital Gains Act 1992.

By way of illustration, Bill and Ben have owned their home together from 2011, they married in 2014 but separated in 2016, and Bill moved out of the matrimonial home. It’s 2021 and they are in the process of divorcing and have decided to sell the property. It was purchased for £650,000 and is now worth £1.5million.

Ben will have no capital gains tax liability on sale as he has lived in the property for the whole period of ownership.

Bill will have an exposure to capital gains tax of £42,000.

(Calculation: sale price less purchase price = £750,000, only 50% of the gain is charged on Bill as the property is owned jointly. Bill lived in the property for six years out of 10 so 60% of the gain will be eligible for PPR relief. 40% of the gain is £150,000, this would be taxed at 28% – this is a very simplified explanation).

If Bill transfers the property to Ben ahead of the sale and claims s.225b election, PPR relief will apply to whole gain and Bill’s liability will be reduced to £nil.

The conditions for the relief are:-

- the property must have been Bill’s main home before he left the property;

- the property must still be Ben’s main home;

- Bill cannot have elected any other property to be his main home;

- the property must be transferred either due to a court order or by way of an agreement;

- the transfer must be being done due to a divorce;

- this treatment must be elected for by Bill.

For this treatment to apply, the s.225b election must be made in writing to HMRC.

If Bill purchases another home before the transfer of the property can be completed, he can choose whether the PPR attaches to the former matrimonial home or to the new property.

In the majority of circumstances an individual can only claim PPR on one property at one time.

Garden and grounds

PPR relief is given up to the permitted area. This is currently up to an acre [7] (including the site of the home). The permitted area can be extended if the grounds are required for the reasonable enjoyment of the house. Generally speaking, a garden is taken to be part of the grounds. The grounds are defined as enclosed land surrounding or attached to a house serving chiefly for ornament or recreation. When considering whether the garden and grounds are reasonably required for the enjoyment of the house, the following criteria Is looked at:

- size and character of the house;

- how the gardens are actually being used;

- are the garden/grounds actually required for the purposes of the taxpayer’s enjoyment;

- the opinion of the HMRC district valuer.

If HMRC disagree that the garden and grounds are reasonably required, they may open an enquiry into the house sale and the relief claimed. Penalties can be charged if HMRC determine that the parties failed to take reasonable care with regards to their tax obligations when selling the property. We are seeing more cases concerning the size of garden and grounds reaching the tax tribunals.

With the introduction of Google Earth, a HMRC officer can view the property and its surrounding grounds without having to leave the office.

PPR relief must be restricted to the property and allowable gardens. Any additional land will not qualify for PPR relief and the gain on this land will need to be calculated.

In Longson v Baker (HMIT) [2001] STC 6,2001 BTC 356 Mr and Mrs Johnstone purchased Velmede Farm, the grounds were converted to be appropriate to keep horses. After divorcing Mr Johnstone, Mrs Johnstone sold the house and the grounds. The question for the court was were the grounds of 3.5 acres required for the reasonable enjoyment of the house?

On appeal by Mrs Johnstone, this case was heard at the High Court. Evans-Lombe J dismissed the appeal, holding that ‘in my judgement it is not objectively required i.e. necessary to keep horses at a house in order to enjoy it’s residence’.

Therefore, in cases where the garden and grounds of the property are over an acre, clients should seek advice as to what portion of the grounds may be subject to capital gains tax on sale.

Second homes

In some cases, individuals will move into their second homes during proceedings. As above PPR relief is available for a residence which an individual lives in as their main home. Unfortunately, there is no statutory definition of ‘residence’ for these purposes. In the case of Iles and Anor v Revenue & Customs [2014] UKFTT 436 (TC) the First Tier Tribunal concluded that for a property to qualify as a residence it must have a sufficient degree of permanence, continuity or expectation of continuity to justify describing that occupation as a residence.

In Stephen Core v HMRC [2020] UKFTT 440 (TC), the taxpayer moved into a property upon which he had already received on offer to sell. The offer was refused prior to the taxpayer taking up residence, but was subsequently accepted. Notwithstanding that the property was occupied only for a period of six to eight weeks, the First-tier Tribunal found that it had been the taxpayer’s main residence as it was only after moving in and receiving a higher offer that the decision to sell was made.

Therefore, in some circumstances where an individual moves into a second home or previously rented out property, they may be able to claim a portion of PPR relief when the property is sold. Whether PPR relief is available will depend heavily on the circumstances.

Deferred Charge

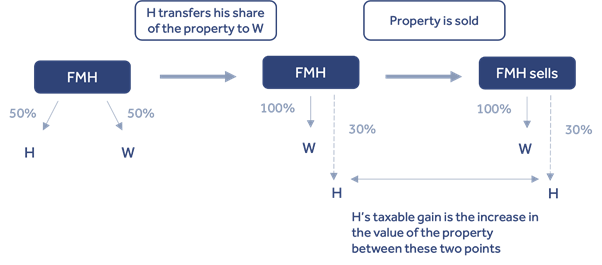

If one party transfers their interest in the property to the other party for an interest in the home, this is often referred to as a deferred charge. The transferor will usually receive a percentage of the proceeds on future sale.

When the property is sold and the individual receives their payment, there will be a capital gains tax liability on the amount they receive. The gain is calculated as the amount they receive on sale less the value of their interest when they received the charge.

If the deferred charge is for a fixed amount (rather than linked to a percentage of the property value) there would be no tax payable on the payment of the charge. This is because there is no tax liability on the repayment of a debt and a fixed sum would be viewed as a debt.

For individuals, debts are assets for chargeable gains purposes[8], however, a chargeable gain or allowable loss does not accrue on the disposal of a debt if the transferor is the original creditor.

[1] 0.5 hectares

[2] Taxation of Capital Gains Act 1992, s222-224

[3] Taxation of Capital Gains Act 1992, s223(2)(a)

[4] Taxation of Capital Gains Act 1992, s223(3)(b)

[5] Taxation of Capital Gains Act 1992, s223(3)(c)

[6] Taxation of Capital Gains Act 1992, s223(3)(a)

[7] Legislation defines the space as 0.5 hectares or 5,000m2

[8] Taxation of Capital Gains Act s21(1)(a)