Introduction to share schemes (part 2)

Tax Advice » August 5, 2024

If your client’s shares are not part of a tax approved scheme they will be considered unapproved shares and regular tax rules will apply.

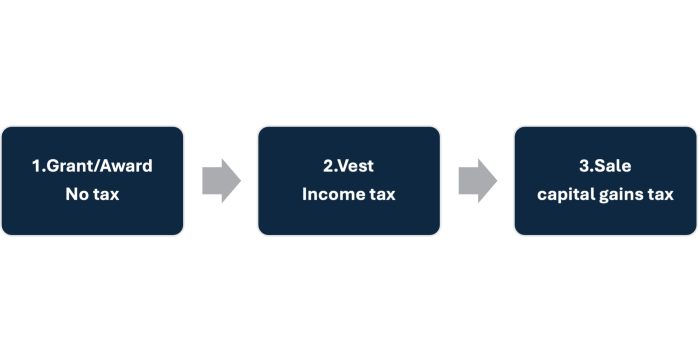

Understanding the share award lifecycle is key to being to understand the actual value of the shares:

1. Grant/Award

When a share is awarded/granted to an employee it is similar to a promise. The employer agrees that the employee can receive the shares if certain conditions are met in the future. Usually the employee has to remain an employee of the company. At this point the employee does not own the shares. There is no tax due at award.

2. Vest

When the shares vest they are delivered into the employees share account. This is the point the employees own the shares. Income tax applies at the vest date. Income tax will be charged at the individuals top rate of tax on the market value of the shares at vest. Usually the company will withhold x amount of shares to cover the PAYE and NIC liability, the net shares will be delivered into the employees share account. After the shares have vested the individual can sell or retain the shares. They will still own the share if the individual leaves the company.

3. Sale

At the point of sale the shares will be subject to capital gains tax if they have increased in value since the point of vest. When working out the potential capital gains tax, you would take the market value at sale and deduct the value of the shares at the vest date. If an employee sells the shares on the same day that they vest there will be no capital gains tax to pay.

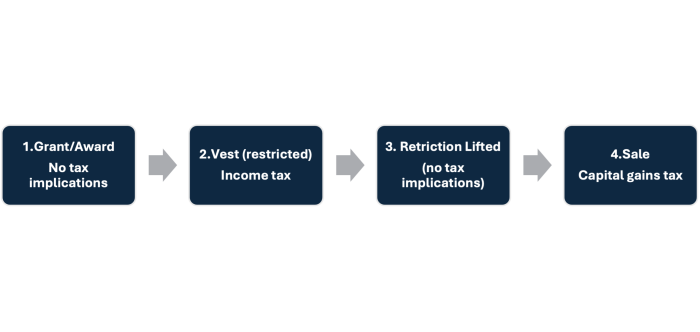

If an employee is a regulated or a senior employee they are likely to have staggered vesting’s and restriction periods. Staggered vesting’s are when the share award vests (say) 25% each year, so the individual will only receive their full award after 4 years.

Restriction periods are once the share has vested the individual is unable to sell the share whilst it is in the restriction period. Some companies will also stipulate that whilst the share is under restriction, it can still be clawed back. A claw back is a contractual agreement where an employee is required to return an amount of variable renumeration (usually shares). If your clients’ shares are subject to any claw back provision the claw back is likely to apply to restricted shares in priority to those where the restriction has been lifted.

There are no tax implications when a restriction is lifted. The tax points are only at vest and sale.

When seeking a tax report on approved plans you will need to provide the following

- Award Agreement

- Share plan agreement

- Vesting schedule

You may need to know both the income tax and future capital gains tax position now and if the shares are retained for their minimum period per the terms.

Sign up to be notified when we publish new articles: Juno Family Newsletter

Need expert tax support?

Find a full list of how Juno can support on our Services page. Alternatively, get in touch with our team at: family@junotax.co.uk