National Insurance & Tax Increases – Summary

HMRC » September 10, 2021

From April 2022:

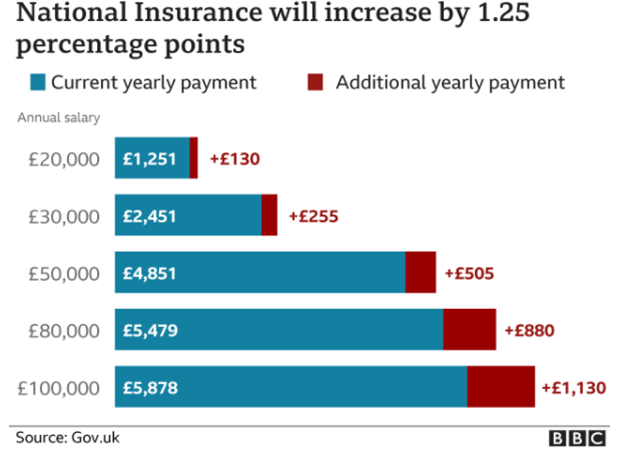

- National Insurance will increase by 1.25% for both employees and employers.

- Tax rates on dividends will also increase by 1.25%

Net income projections for 2022 onwards will need to be updated to account for these changes. The hardest hit will be small business owners who face increases in Corporation Tax and increase in the dividend tax rates.

In this quick summary we talk through the changes to the tax rates and the impact this will have on a client’s income.

On Wednesday, 8 September 2021 the parliament held a vote to introduce a new 1.25% “health and social tax” and increase the dividend taxes.

The 1.25% increase in tax will be collected via NICs by both the employer and employees starting from April 2022. Collectively, this is a 2.5% increase per working individual.

Starting from April 2023, this will then become a separate tax on earned income, known as the “Health and Social Tax Levy”. This levy will be collected via PAYE. Unlike standard National Insurance, from April 2023 this will also be payable by individuals who continue working beyond their pensionable age. Anyone who earns under £9,564 will not be subject to this new levy.

It was also announced that from April 2022, there will be the same increase on the Income Tax payable on dividends. This means that from April 2022 the tax on dividends will be 8.75% for basic rate taxpayers, 33.75% for higher rate and 39.35% for additional rate taxpayers.

It is clear that the increase in dividend rates will predominantly impact those with a higher value portfolio and business owners.

Corporation Tax is also due to increase in the future, so business owners will face higher taxes on withdrawing cash from their business than they have in the recent past.

On a positive note, there seems to be no rise to the Income Tax at present, but there is no certainty that Capital Gains Tax will not be targeted to change next. Capital Gains Tax could well be next on the ‘hit list’ to change / increase. This change of taxes is estimated to bring in £12bn a year in comparison to the total costs of the Coronavirus pandemic running into the hundreds of billions…so additional tax increases are likely.

The Chancellor has announced that the next Autumn Budget will be held on 27 October 2021.

As usual, we will be holding a Post Budget webinar to run through the changes and how they may impact divorcing couples.

Details of this webinar will be shared via our newsletter.

If you are not already on our mailing list to receive our fortnightly newsletter which contain tax updates, case studies, Q&As, as well as details of our events, please sign up by using the link at the top right hand corner of our website.