Offshore Assets & Income

HMRC » November 19, 2021

The Details

The most common penalties for failing to disclose offshore assets and income in the UK are up to 200% (and in some cases this rises to 300%). HMRC has access to data from over 100 countries and they use this to spot non-compliance. There is no immunity from prosecution even if the disclosure is made voluntarily and the timeframe for HMRC to open investigations can go back 20 years.

The deadline for individuals to register with HMRC to make a tax disclosure under the Requirement to Correct (RTC) has now passed. The RTC rules required any person with historic offshore irregularities as at 5 April 2017 to correct them by 30 September 2018[1]. Now the new Failure to Correct (FTC) penalties are in force for all individuals who have failed to notify HMRC about offshore income and gains for the tax years 2015-16 and earlier.

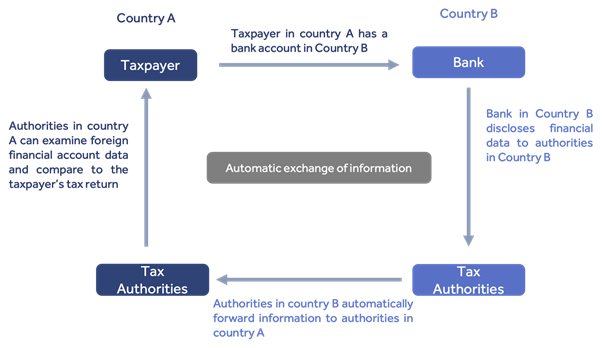

The Organisation for Economic Co-operation and Development (OECD) developed a Common Reporting Standard (CRS) for the automatic global exchange of financial information[2]. Since September 2018, over 100 countries exchange information annually with HMRC. Some of the notable countries included are Hong Kong, Monaco, Switzerland and the Bahamas. HMRC analyses the data it receives, comparing it to tax returns and other information it already holds, to identify taxpayers to investigate. Therefore, individuals who have previously failed to declare their offshore income and gains are at risk of investigation by HMRC and eye-wateringly high penalties.

Illustration of Automatic Exchange of Information

The information exchanged is:-

- account number;

- name, address, date of birth;

- tax ID number;

- interest and dividends;

- credit balances on account;

- proceeds from the sale of financial assets.

Offshore matters

This section details when penalties may apply where there is offshore non-compliance in relation to income tax, capital gains tax or inheritance tax which involves either:

- an inaccuracy;

- a failure to notify;

- the deliberate withholding of information.

An offshore matter is where the potential loss of tax is charge on or relates to:-

- income arising from a source outside the UK;

- assets situated or held outside the UK;

- activities carried on wholly or mainly outside of the UK;

Individuals that fall within the FTC penalty regime must meet both of the below:-

- they must have been non-compliant during 2015-16 or prior;

- they failed to disclose this non-compliance on or before 30 September 2019[3].

Penalties

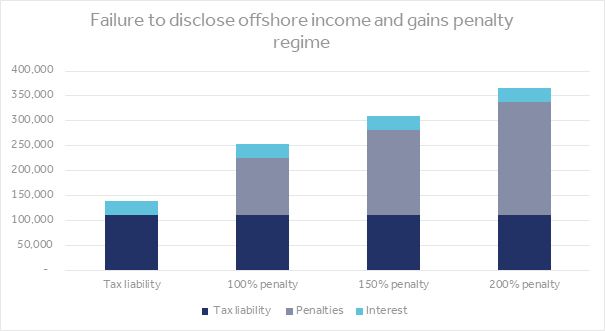

FTC penalties are a minimum 100%[4] of the tax owed in relation to any offshore non-compliance. This penalty can be reduced to nil if the taxpayer took reasonable care.

The maximum penalty rate is 200%[5] of the tax owed. This can be reduced by the quality of the disclosure.

Unlike the general penalty regime, these penalties do not vary according to behaviour. For example, it does not matter if the behaviour was careless or deliberate. Equally the location of the income, gains or assets does not impact the penalty rate.

The standard 200% penalty can be reduced to a minimum of 100% where the disclosure is voluntary and 150% where the disclosure is non-voluntary. A disclosure is deemed non-voluntary if HMRC have reached out to the taxpayer either through a nudge letter or information notice.

Where there is an issue of non-compliance in relation to offshore matters, there is an advantage to the taxpayer to voluntarily disclose as they will then be within the lower penalty regime.

Illustration

Mr and Mrs Baros are UK resident and domicile. They own 20 holiday villas in Greece (total value of £1.5m) which they rent out. They are both additional rate taxpayers. Between 2012 to 2016, they received £50,000 profit per annum from their properties. This income was declared in Greece, but it was not declared in the UK. The income from 2012 to 2016 will be subject to the FTC penalties as above.

As the below table shows, if Mr and Mrs Baros were successful in claiming they took reasonable care, they would be liable for the tax and interest only, being just under £150,000.

If HMRC wrote to Mr and Mrs Baros prompting a disclosure, they could face penalties of 200% of the tax payable, therefore, their total liability would increase to £365,625.

Asset based penalties

Individuals may have to pay an asset-based penalty if all of the following apply[6]:-

- the individual has been charged with an underlying penalty for a deliberate inaccuracy, failure to notify or for deliberately withholding information or an FTC penalty;

- the inaccuracy or failure relates to an offshore matter;

- the income, gain or transfer of value that relates to the inaccuracy has a clear link to the underlying asset;

- the potential amount of tax at stake relating to the offshore matter exceeds £25,000 in a single year; and

- the underlying penalty relates to capital gains tax, inheritance tax or ‘asset-based income tax’.

Amount of the asset-based penalty

The standard amount of the asset- based penalty is the lower of:-

- 10% of the value of the asset;

- 10 x the offshore tax at stake.

If Mr and Mrs Baros received an asset-based penalty, this would increase their total liability by £150,000.

Asset moves penalty

There is an enhanced penalty regime[7] for cases where a person is found to have moved certain (hidden) offshore assets from one (comparatively secret) jurisdiction to another (transparent one, part of the common reporting standards automatic exchange of information) to avoid detection.

The penalty is charged at 50% of the amount of all other penalties being charged and is charged in addition to these penalties. Therefore a 200% FTC penalty could become 300% if the asset moves penalty applies.

Time Frames

Whilst HMRC have access to huge amounts of data from different countries, they were concerned about the amount of time it would take them to analyse vast amounts of data to identify discrepancies. The Finance Bill No 3[8] increased the amount of time HMRC has to open an enquiry into a tax-payer where they believe there has been offshore non-compliance.

The previous time frames of four and six years were extended to 12 years for income tax, capital gains tax and inheritance tax relating to offshore matters. Under the old rules (and existing rules for onshore matters) if a taxpayer had taken reasonable care or had a reasonable excuse, HMRC only had a window of four years to open an enquiry.

Process for disclosing offshore income and gains

HMRC have an online disclosure facility for disclosing offshore income and gains. The first step the taxpayer must take is to notify HMRC about the intention to disclose. From this date, they have 90 days to complete the disclosure.

The disclosure letter is then submitted to HMRC, this will detail the nature of the non-compliance, tax due because of the non-compliance, penalty rates applied and interest due. HMRC will then either agree with the disclosure by sending a letter of acceptance of they will ask for further information.

The length of time between submitting the disclosure and receiving an acceptance from HMRC has increased due to the pandemic. There are few official statistics surrounding the responses to the worldwide disclosure scheme, but HMRC response times have reportedly trebled[9]. In the writer’s experience, it can take up to 12 months until an acceptance is received and the matter is closed.

[1] Finance Act (no.2) 2017, Sch 18 and s 67

[2] https://www.oecd.org/tax/automatic-exchange/

[3] Finance Act (no. 2) 2017 Sch 18

[4] Finance Act (no. 2) 2017 Sch 18, para 16 (5)

[5] Finance Act (no. 2) 2017 Sch 18, para 14 (1)

[6] Finance Act 2016 Sch 22

[7] Finance Act 2015, Sch 21

[8] Finance Bill No 3 Clauses 79 and 80

[9] https://www.thetimes.co.uk/article/hmrc-tax-office-in-turmoil-as-waiting-times-treble-qlqkfsh5n