Useful UK Tax Calculators for Family Solicitors

Tax Advice » July 11, 2024

If you are working with clients and you’re unsure if tax advice would add value to their case – consider using these signposts.

There are many reasons why clients may not want to seek tax advice but where an indication of tax due would be helpful. Maybe the assets are of low value or the client does not have the funds or desire to seek out tax advice.

These are the most helpful places I signpost people who need free advice;

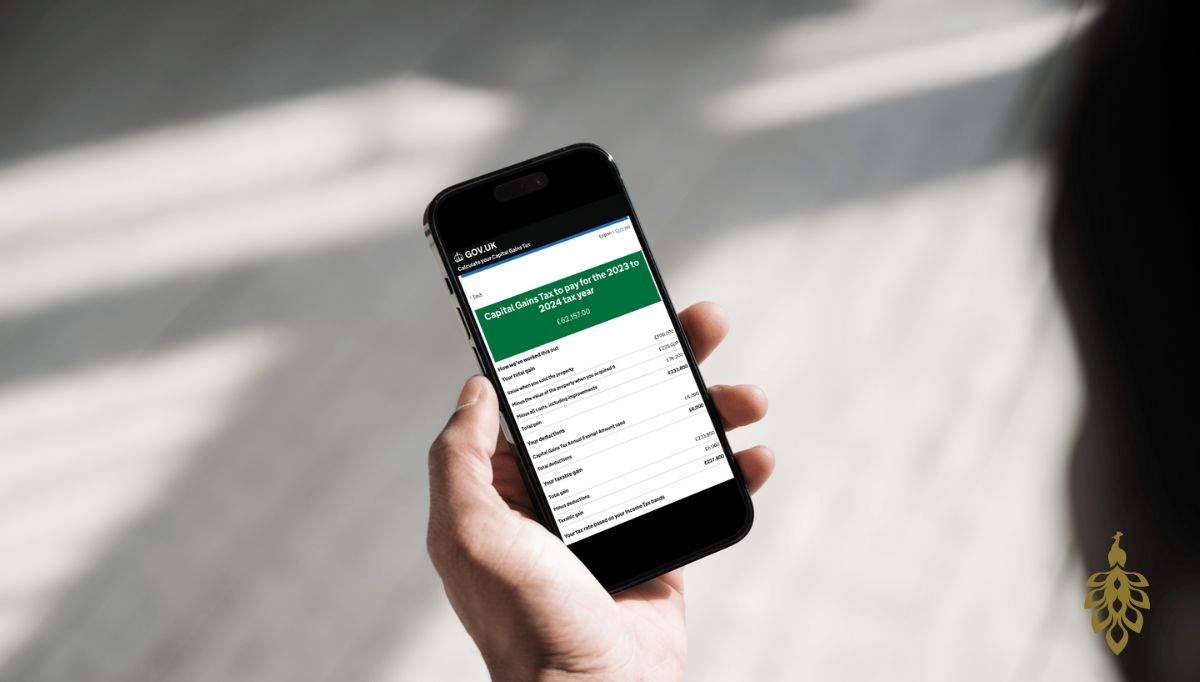

All of these links are to the .gov website. None of them require a sign in or any personal information. Once the information is inputted, the calculator will deliver the tax due and a helpful summary which can be PDFed and added to the clients file.

The limitations on these calculators is that they cannot apply any reliefs or work out any reliefs. Therefore these are best placed for the very simple cases.

CGT on share sale – https://www.gov.uk/tax-sell-shares/work-out-your-gain

CGT on property sale – https://www.gov.uk/tax-sell-property/work-out-your-gain

Income Tax Calculator – https://www.gov.uk/estimate-income-tax

Self Employed Tax Calculator – https://www.gov.uk/self-employed-tax-calculator

Sign up to be notified when we publish new articles: Juno Family Newsletter

Need expert tax support?

Find a full list of how Juno can support on our Services page. Alternatively, get in touch with our team at: family@junotax.co.uk