Using Capital Losses to Reduce Tax Liability

Tax Advice » December 3, 2021

Due to the pandemic, many individuals hold investments which are worth less now than when they bought them. Worthless assets may not be considered of importance in divorce, but if these assets are sold or transferred, the seller/transferor can use the losses to reduce their tax liability. Capital losses can be offset against capital gains to reduce taxable gains and, in certain circumstances, capital losses can be offset against taxable income.

This article will talk through what capital losses are and how individuals can utilise them to reduce their tax liabilities.

What are Capital Losses?

Simply put, an individual has a capital loss when they hold an asset which is worth less now than when they initially purchased it. Working out a loss is similar to a gain – it’s the sale price of the asset less the acquisition costs, sale costs and purchase price. If the asset is being transferred, we replace the sale price with market value.

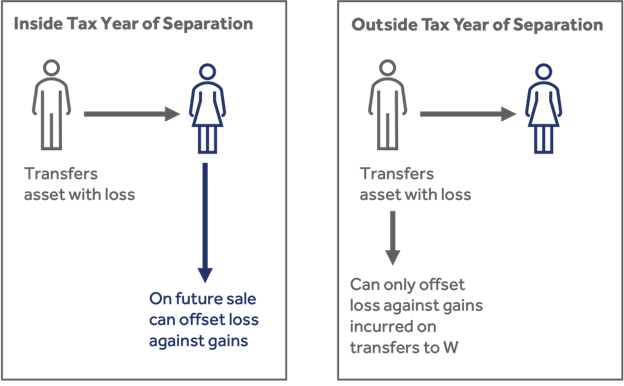

When assets are transferred on divorce, there is a different treatment for assets with a latent loss. If the transfer is completed inside the tax year of separation, then the loss will be transferred over to the receiving spouse. The receiving spouse can utilise this loss to reduce their taxable gains if they crystalise the loss. If the transfer is completed outside of the tax year of separation, the transferring spouse incurs the loss. However, they can only offset the loss against gains to the same person. The loss is ringfenced. See illustration below.

Capturing Losses

If an asset is sold for a loss, this should be reported on the individual’s self-assessment tax return. Losses are first offset against gains incurred in the same tax year. Utilised losses can be carried forward indefinitely. Losses cannot be carried backwards (apart from on death), therefore, it is important that the timing of sale or transfer is planned when disposing of assets with a loss.

Negligible value claims

If an unquoted trading company has lost all of its value, the shareholder should consider making a negligible value claim. This is made through HMRC and the effect is to treat the shares as if they were sold for nil.

Usually, capital losses can only be deducted from gains, however, losses in respect of an unquoted trading company can be offset against income.

By way of example, Magdalena & Sven are divorcing. Magdalena has a business which she set up by subscribing for £40,000 for shares many years ago. She is also employed and earns £50,000 per annum. The business now has no value. If Magdalena makes a negligible value claim to HMRC, she will crystalise the loss and can offset this against her taxable income.

| With the claim | Without the claim | |

| Total income | 50,000 | 50,000 |

| Less losses | (40,000) | – |

| Less personal allowance | (12,500) | |

| Taxable | – | 37,500 |

| Tax liability | – | 7,500 |

Key takeaways

- Losses shouldn’t be ignored.

- Individuals should include assets of nil value on their Form E.

- Where losses exist, a strategy should be implemented to ensure these are utilised most effectively. Usually this would be done with the support of a tax expert or via a SJE report.