HMRC Enquiries and the Internal Appeal Process

HMRC » September 10, 2021

HMRC’s annual report shows that on review only 43% of decisions were upheld. In this blog we cover the basics of HMRC enquiries and how to request a statutory review. In many cases the review process can expedite an ongoing enquiry and provide certainty to both parties of the final liabilities payable to HMRC.

If you are working on a case where either party are under HMRC investigation you can see our list of questions to ask covered in this blog here.

HMRC Enquiries

HMRC are opening more and more enquiries into self-assessment taxpayers. Unfortunately not all HMRC enquiries are opened under the right powers, and all clients should seek advice before responding to a HMRC enquiry.

When can HMRC open an enquiry?

HMRC raise multiple enquiries each year. Sometimes these are referred to as normal “compliance checks”. These are in place to ensure the tax return and the disclosures within the tax return are completed correctly.

HMRC do also sometimes open an enquiry on a random basis. This is to discourage tax evasion as well as build confidence within the general public to reassure them that the tax system in place is a fair operation.

Time frame for opening an enquiry

An enquiry can only be opened once a client has submitted a tax return. HMRC has a 12 month enquiry window from the date the tax return is due to issue this notice. This means for the tax year 2020/21, the enquiry window would be open until 31 January 2023. HMRC have up until that date to send you a Notice of Enquiry letter.

However, if the tax return is submitted after the due date, the enquiry window is extended to the next quarter following the one year submission anniversary.

If the enquiry is opened due to an incomplete tax return or disclosure, HMRC have four years from end of tax year to issue a Discovery Assessment (S34(1) TMA 1970). HMRC must be able to show that a loss of tax has been brought about by the taxpayer/agent in order to issue the Discovery Assessment for the missing tax.

How are they different depending on behaviour?

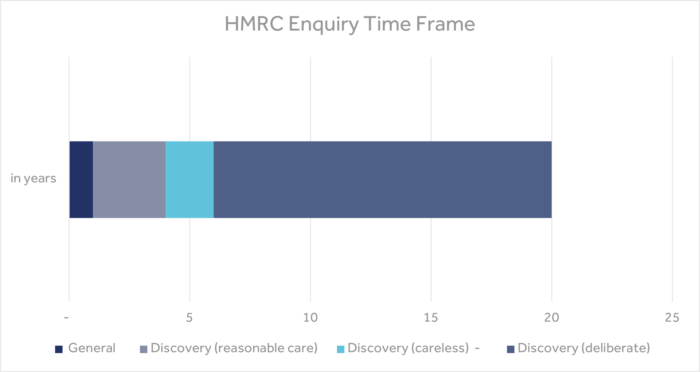

If HMRC has reason to believe that the tax return was completed carelessly or deliberately inaccurate, the window to issue an Enquiry Notice can be extended. These investigations are known as “Discovery Assessments” and can date back to 20 years depending on your behaviour.

In order to issue a successful Discovery Assessment, HMRC must show that they have an arguable case and reasonable cause that the entries made within the tax return submitted were either careless (can go back to six years), or dishonest (can go back to 20 years). There is case law in place to support this under Hegarty [2018] UKFTT 0774 (TC) and Brannigan [2006] EWHC 885.

How should a client respond if they receive a notice that they are under enquiry?

If your client has become subject to an enquiry, it is important they don’t panic. Receiving a notice to enquiry does not mean that they have done anything wrong or that HMRC have firm evidence regarding any wrongdoing within their tax affairs. It could be a random enquiry or a compliance check. We understand that receiving a Notice of Enquiry can be stressful for all parties involved, but if they know their rights, it can take some of the stress away.

Firstly, they should check whether HMRC is within the time limits for opening an enquiry? If not, then they do not have to respond. HMRC missed their chance and now it’s too late.

Secondly, always check whether the information HMRC have requested is reasonable? Our advice is to always only provide whatever you believe is reasonably required to close the enquiry.

There is no harm in challenging HMRC as to why they think the specific information requested is needed to check your tax position. Clients are under no obligation to provide HMRC with the documents especially if you feel they are irrelevant or confidential. Providing HMRC with these documents would only extend time spent and add costs to the investigation/compliance check.

In Long v Revenue and Customs Comrs (2014), the tribunal judge ruled that a doctor’s appointment diary was not reasonably required and, therefore, not legally enforceable.

Always remember that HMRC are not allowed to go on a fishing expedition in the hope to recover something when opening an enquiry, therefore, any inconsequential requests made by them should be challenged.

Thirdly, clients should always check whether they can comply with any timescales set for correspondence. If the timescales cannot be met, clients should contact HMRC to agree an alternative timescale. It is always best to work with them collaboratively but also work within the client’s rights.

Appealing a decision

If a client disagrees with an appeal decision that HMRC make, they can ask for a statutory review of the decision. Reviews and appeals are generally dealt with by review officers who are tax, legal and accountancy professionals working within HMRC. The review process provides an additional opportunity to resolve disputes without the need for a tribunal hearing which can be time consuming and costly. Review officers are not involved in making the original decision and so provide an objective, impartial review service. Review officers check whether the decision is in line with the legislation and technical guidance, policy and practice.

In the HM Revenue & Customs Annual Report and Accounts 2019 to 2020, 43% of cases that went through an internal review were upheld. In 2020, 10,239 cases out of 22,649 cases had the decisions cancelled.

How can we help?

Here at Juno Family we have extensive experience in dealing with all manners of HMRC investigations. We can help manage the process on your behalf, making it efficient and cost effective wherever possible. The outcome of the enquiry will depend on you knowing your rights as a taxpayer and having the correct technical guidance from a Tax Consultant. Every investigation is dealt with on a case by case basis. Please reach out if you think we can assist you or your clients.