Non Dom tax considerations for clients moving overseas

Non Dom » July 4, 2024

With the announcement to changes to the non dom regime in the UK, we may see more clients interested in leaving the UK. This article looks the tax considerations for clients moving overseas.

Leaving the UK can create significant tax savings for individuals, however, the number of days that they come back to the UK or a change in circumstances meaning they have to relocate back to the UK can remove those tax savings.

In the UK, individuals are taxed on their worldwide income if they are both resident and domiciled in the UK. Once an individual becomes non-resident, they are taxable on some of their UK source income and gains only.

If they own a property in the UK, and they sell this whilst they are not resident in the UK, it will remain taxable in the UK. However, if they own a business in the UK and they sell the business or shares whilst they are not resident in the UK, the gain will not be taxable.

For example, Mr X has a company in the UK worth £12 million which he is planning to sell. If he sells the company whilst he is resident in the UK, he will pay Capital Gains Tax (CGT) of £2.3m (being 10% on gains up to £1m and 20% on the excess gains).

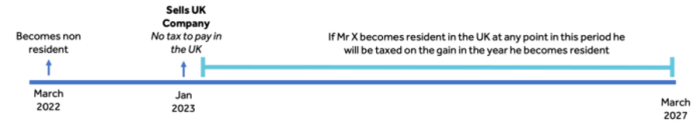

If Mr X was non-UK resident at the time of the sale, he would not pay tax in the UK on the sale of the business. There are some significant caveats to this. If Mr X has been living in the UK for at least four years before he becomes non-resident, then he is taxed under the temporary non-resident rules. This means that if he becomes resident in the UK within five years of the sale of the business, he will be taxed on the sale in the year he returns.

The most important factor is ensuring that Mr X is non-resident before he incurs the gain, then the usual subsequent question is, how many days can Mr X spend in the UK before triggering residency in the UK (and of course a significant tax liability)?

Breaking Residency

If a person leaves the UK for full-time work overseas, they will be automatically non-resident. If this is not the case, then we look at the number of days they spend in the UK in the tax year. If they have been in the UK for under 16 days, then again, they will be automatically non-resident.

Restrictions on days back in the UK

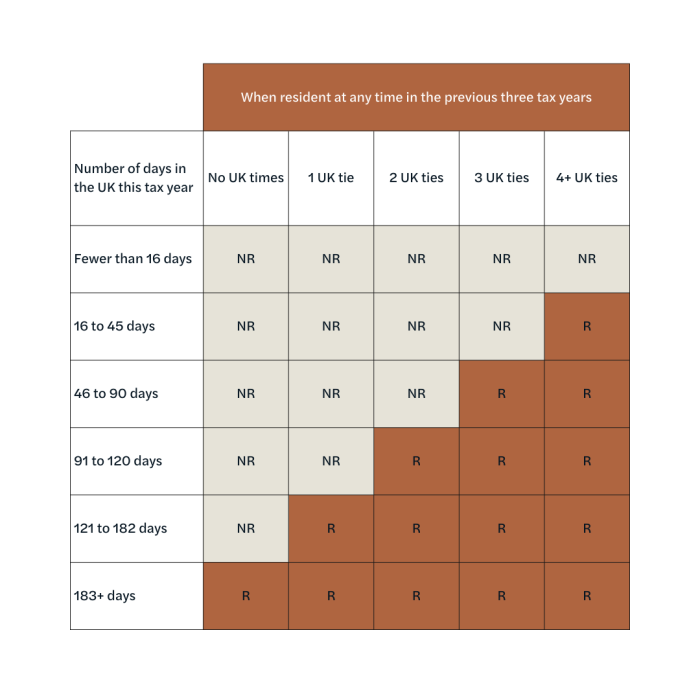

If they do not meet either of the above tests, then we look at a combination of both the number of days in the UK combined with the number of ties they have with the UK.

The ties are:

- Do they have a UK resident family? (A UK resident family is either a spouse or children under 18)

- Do they work in the UK for at least more than 40 days a tax year?

- Do they have a home they can stay in in the UK?

- Were they present in the UK for more than 90 days in the previous two tax years?

If we assume Mr X has children in the UK and a UK home, then he has three UK ties (UK home, UK family and he has been present in the UK for more than 90 days in the last two tax years).

Using the table below, Mr X can be present in the UK for up to 45 days per tax year and retain his non-resident status. If he started working in the UK for more than 40 days (four UK ties), then the maximum number of days he could stay in the UK per year would drop to 15 days.

Key Takeaways

- If your client plans to live overseas and sell or transfer their investments or a business, this transaction may be outside the scope of tax in the UK. Properties are still taxable in the UK even if the individual is non-resident

- When making provisions for the potential tax liability, consider that the tax would become due if your client needed to return to the UK within five years of leaving and this would result in the tax being payable in the year of return.

- These rules are complex, and the above is a brief overview, please ensure your client seeks tax advice if the situation applies to them.

Sign up to be notified when we publish new articles: Juno Family Newsletter

Need expert tax support?

Find a full list of how Juno can support on our Services page. Alternatively, get in touch with our team at: family@junotax.co.uk